In the past, the only way you could interact with a financial professional was through a physical visit at the local bank. Withdrawing or depositing money was a task that was reserved for after work or during the weekend. Smartphone technology and associated mobile websites have changed both society and the financial industry. Banking can be completed at almost any time of day. Explore how mobile websites are changing the financial world for the better.

- Consumer Awareness Benefits Financiers

Mobile websites are changing the financial industry with better customer awareness. No longer do bankers need to notify account holders with a monthly statement that might be overdraw or filled with fees. At any time of day, consumers know their balance and investment choices so that there’s no surprises along the way. When consumers are more in tune with their money, the financial industry benefits with higher confidence levels. Consumers trust in banks, so they’ll deposit more money into the system instead of hiding it away in a drawer at home.

- Deposits, Transfers and More

Consumers appreciate the ease with which their money can be accessed. Banks with a mobile website are benefiting with more customers joining their facility. If a lending facility doesn’t have a mobile element yet, their joining numbers might slow as technology continues to tempt consumers to other banks. They want the ease of direct deposit, instant transfers and other features. Depositing a check with a photo of its amount is a financial achievement that keeps money flowing through the banks at all hours. This feature alone can drive the bank’s success as the economy ebbs and flow.

- Instant Charge Alerts

More trust is being built between consumers and financial institutions as a result of mobile websites. Specific alerts can be set up on their accounts, such as an email or text sent out when a withdrawal of over $100 is made. These alerts are nearly instantaneous, and they keep consumers updated about their accounts between login sessions. Banks with these alerts can keep consumers happy with their services while remaining with the institution for many years.

- Borrowing Money

It’s simply easier to borrow money in this mobile-website world. Consumers might look for title loans online or a specific savings account. Consider a few of the accounts that might be created and maintained with a mobile element, such as:

- Car loans

- Mortgage refinancing

- Personal borrowing

Most loans require some face-to-face element at some point, but the majority of the process can be completed through mobile websites. The financial industry can see more borrowers as a result of the easy access. They simply need to stand out from their competitors with a simple form and streamlined funding process.

- Fewer Brick-and-Mortar Facilities

A major change that results from mobile websites is the need for fewer banks in the neighborhood. Grand buildings used to greet consumers as they handled their money. Currently, you almost never need to visit a bank unless there’s a substantial monetary issue at hand. As a result, banks can concentrate their services at the consumer level instead of funding the overhead on physical locations. Fees and other charges drop in price because the overhead is minimal.

From virtual accountants to check-sensing camera angles, mobile websites can only improve from this day forward. Accessing and controlling your money has never been easier in today’s connected world.

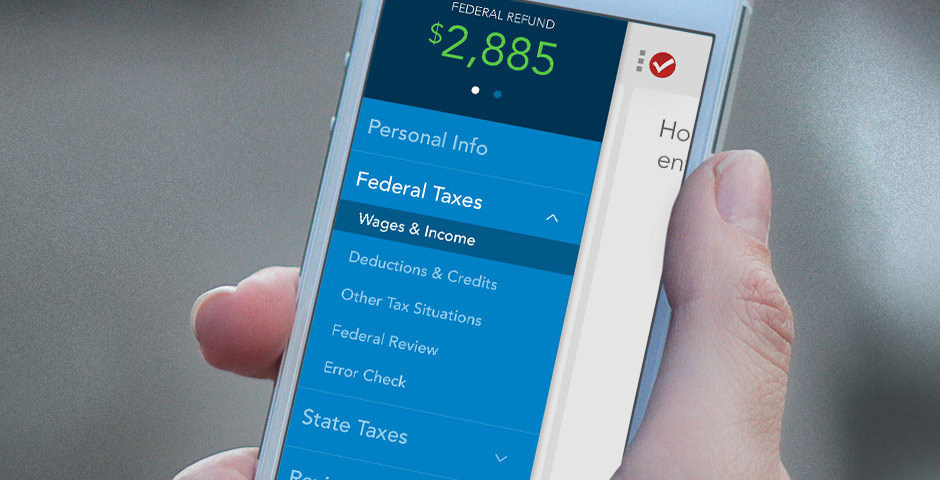

Featured Image